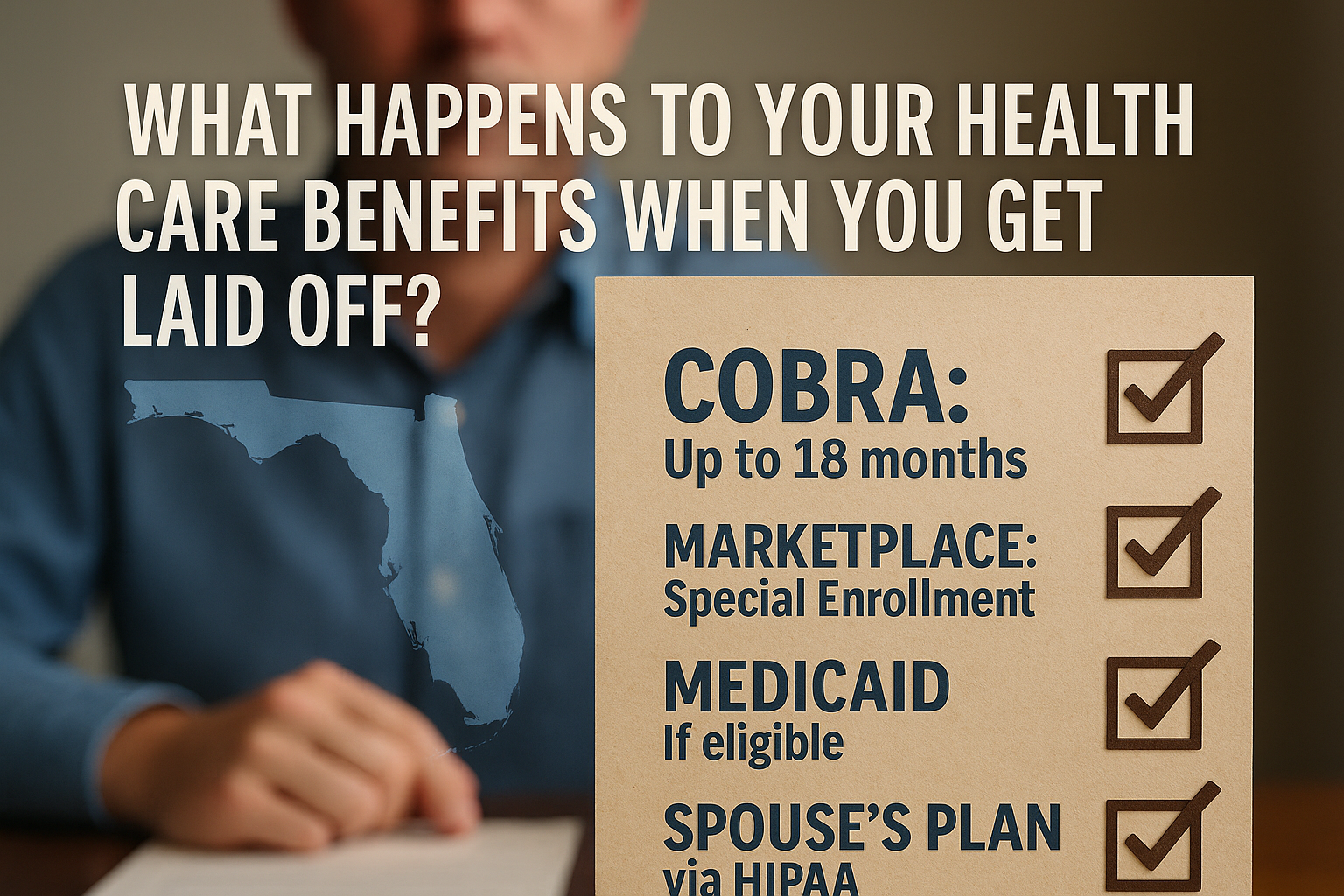

1. Immediate Coverage: Your Employer Plan & COBRA

- Final Pay Period: Your employer-sponsored plan typically remains active through the last day of your current pay period.

- COBRA Continuation: Under federal COBRA rules, you’re eligible to continue your group coverage for up to 18 months.

- Cost: You’ll pay full premiums (both what you paid and what the employer paid) plus a 2% administrative fee.

- Enrollment Window: You have 60 days from the date you receive your COBRA election notice to sign up.

- Florida Specifics: Florida follows the federal COBRA rules without additional state mandates.

2. ACA Marketplace: Special Enrollment Period

- Qualifying Event: Job loss triggers a Special Enrollment Period (SEP) on HealthCare.gov.

- Deadline: You must enroll within 60 days before or after your last day of coverage.

- Subsidies: Florida residents may qualify for premium tax credits and cost-sharing reductions if your income falls between 100% and 400% of the Federal Poverty Level.

- Plans & Coverage: You can compare Silver, Gold, and Bronze plans that suit your budget and medical needs.

3. Medicaid & Florida’s Safety Net

- Eligibility: Florida did not expand Medicaid under the ACA, so eligibility is generally limited to very low-income adults (e.g., pregnant women, parents/caretakers, individuals with disabilities).

- Application: You can apply year-round through the Florida Department of Children and Families (DCF).

- Look for Waivers: Certain home- and community-based services waivers may help seniors or people with disabilities.

4. Spouse or Domestic Partner’s Plan

- HIPAA Special Enrollment: If your spouse or partner has employer-sponsored coverage, you have 30 days from job loss to join their plan.

- Documentation: You’ll need proof of the qualifying event (e.g., layoff letter) when you request enrollment.

5. Short-Term Plans & Alternatives

- Short-Term Health Plans: Available in Florida for up to 364 days (with renewals).

- Pros: Generally lower premiums.

- Cons: May exclude pre-existing conditions and have limited benefits (e.g., no maternity coverage).

- Professional Associations or Alumni Plans: Some trade groups and universities offer group coverage options at competitive rates.

- Health Care Sharing Ministries: Not insurance but can help share qualifying medical costs among members.

6. Key Tips & Deadlines

- Mark Your Calendar:

- COBRA Enrollment: Within 60 days of your notice.

- Marketplace SEP: Within 60 days before or after coverage loss.

- Spouse Plan Enrollment: Within 30 days of job loss.

- Compare Costs: COBRA may be more expensive than marketplace plans with subsidies.

- Stay Informed: Visit Healthcare.gov, Florida’s DCF site, and your former HR department for guidance.

- Plan Ahead: If you expect a period without coverage, budget for potential out-of-pocket and premium costs.

Florida residents have multiple pathways to secure new coverage

A layoff doesn’t have to leave you uninsured. Florida residents have multiple pathways to maintain or secure new coverage—whether through COBRA, the ACA Marketplace, Medicaid (if eligible), a spouse’s plan, or alternative options like short-term insurance. Timely action and comparison shopping can help you find the coverage that best fits your healthcare needs and budget.